how much does a tax advocate cost

There are three options for appealing an Individual Income Tax Notice of Refund Adjustment or Refund Denial. Remediating these problems will cost money.

Irs Tax Refund Delays Are Likely In 2022 Taxpayer Advocate Money

Clarification needed is the person who prepares and files the Certificate of Incorporation with the concerned state.

. Carbon taxes are intended to make visible the hidden social costs of carbon emissions which are otherwise felt only in indirect ways like more severe weather events. 50000 Taxable Value Reduction x 0225 Typical Tax Rate x 4 Essential Plus Success Fee 1125 Tax Savings to client and 450 Success Fee NO SERVICE FEE 0 Taxable Value Reduction 149 Service Fee NO SUCCESS FEE. Businesses that are still operating and only owe Form 1120 income tax or Form 1065 late filing penalties.

Our tax rate of 2183 is the fourth highest in Massachusetts and our hefty average tax bill puts our town at No. For more information on consistent basis reporting see Column eCost or Other Basis in the Instructions for Form 8949. The cost of her health insurance premiums in 2021 is 8700.

No timing belts or fan belts maintenance costs may also potentially be lower. You may request an Informal Conference with the Departments Hearings Division by sending a letter to PO Box 30058 Lansing MI 48909 within 60 days. A silver plan is a health insurance plan where the insurer pays on average 70 of the cost of covered services.

2 Assessed tax balance from 25001 to 50000 include all assessed tax penalty and interest in computing the balance due. Furthermore since electric vehicles have fewer moving parts no exhaust system and fewer parts that need to be changed eg. An example of using your tax transcript to get IRS payment information was provided by some readers around their economic impact payments stimulus.

IRS Form 941 Employers Quarterly Federal Tax Return is used by an employer to report federal income tax withheld from employees including withholding on sick pay and supplemental unemployment benefits plus the employers and employees share of social security and Medicare tax. You may petition for a Hearing with the Michigan Tax Tribunal within 60 days. Theyre setting up your return and when theyre set theyll post the date your rebate will be open or a message abo.

It infers definitely what it says. A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Incentives for solar and batteries are also important components of the overall cost of a solar system.

For more information on basis of inherited property generally. The premium tax credit is limited. The most widely available incentive is the federal tax credit currently set at 26.

Bankrate LLC NMLS ID 1427381 NMLS Consumer Access BR Tech Services. In the USA operating an electric vehicle cost around 485 a year whereas the average amount for a regular gas-powered vehicle was 1117. If an estate tax return wasnt filed your basis is the appraised value of the home at the decedents date of death for state inheritance or transmission taxes.

If you go for a snagging report more appropriate for new-builds this can cost 100s but in some cases can be free. Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value. Businesses that have gone out of business that owe any type of tax.

Advance payments of the premium tax credit of 4200 are made to the insurance company and Amy pays premiums of 4500. On her 2021 tax return Amy is allowed a premium tax credit of 3600 and must repay 600 excess advance credit payments which is less than the repayment limitation. No one seems to know.

The Taxpayer Advocate Service developed the Premium Tax Credit Change Estimator to help you estimate how your premium tax credit will change if your income or family size change during the year. There are three kinds of surveys to choose from. A refund date will be provided when available indicate.

Just be aware that your tax transcript does update regularly during tax season so should using in conjunction with the WMRIRS2Go refund trackers in addition to any official correspondence or updates. Solicitor conveyancer fees. What does IRS tax message Your tax return is still being processed.

A homebuyers report will cost from 500 to 1000 while a full structural survey will cost up to 1500. There are other important incentives as well depending on location such as New Yorks 25 state tax credit and Californias SGIP program for solar. Answer 1 of 18.

This is available to. Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. In this way they are designed to reduce carbon dioxide CO 2 emissions by increasing prices of the fossil fuels.

How To Become A Tax Consultant

Taxpayer Rights Taxpayer Advocate Service

Why Tax Lawyers Are The Richest Lawyers

Top 5 Income Tax Lawyers In India And One Landmark Case They Argued

This Infographic From The National Taxpayer Advocate Highlights Some Of The Most Serious Problems Faxing Taxpayers Today Serious Problem Infographic Advocate

Taxpayer Rights Taxpayer Advocate Service

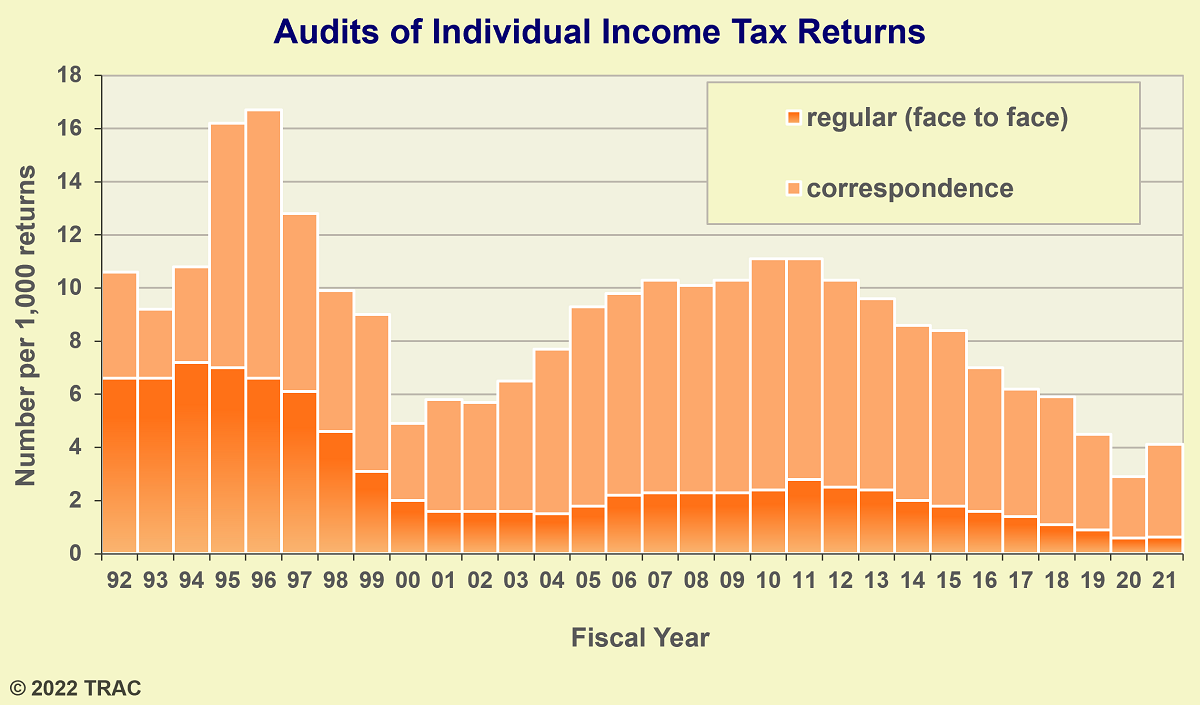

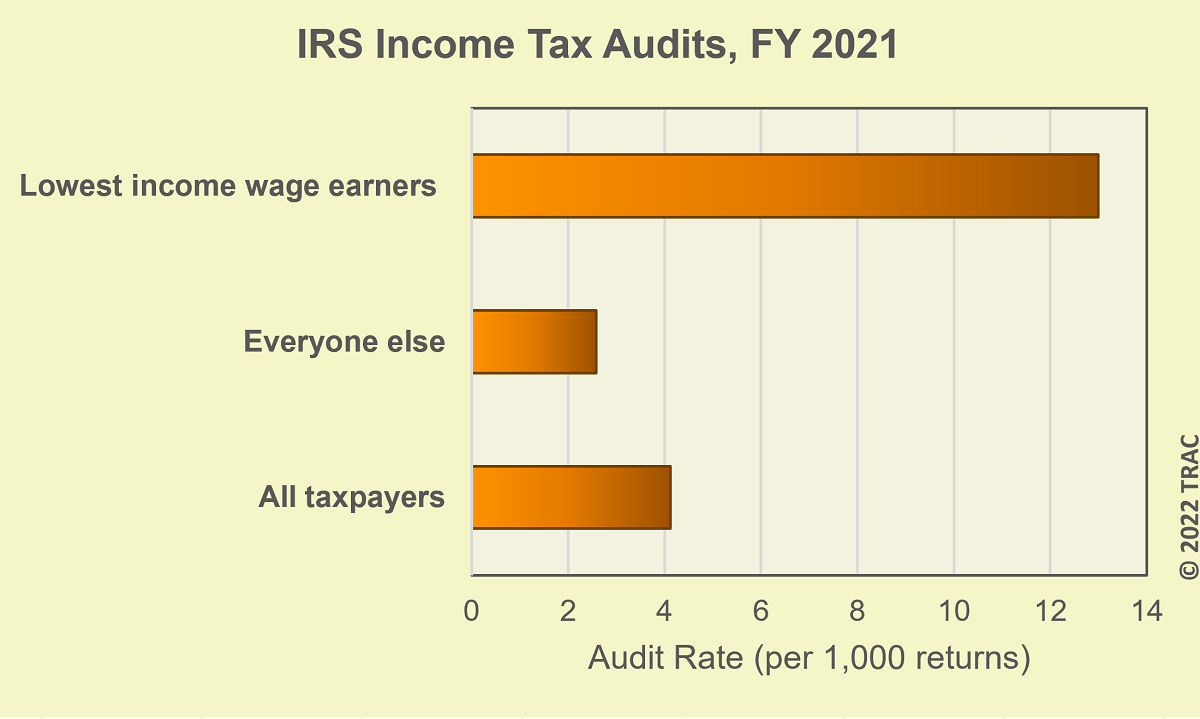

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Benefits Of Gst Tax Advocate India Prevention Advocate Benefit

About Us Taxpayer Advocate Service

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Irs Halts Plans To Close Processing Center Amid Substantial Backlog Accounting Today

Taxpayer Advocate You Literally Need A Map To Navigate Our Tax System So They Made One Us Tax Roadmap State Tax

Irs Taxpayer Advocate Service Local Contact Hours Get Help

Where S Your Refund Veteran Taxpayer Advocate Offers Tips On Dealing With The Mess At The Irs

![]()

Our Leadership The National Taxpayer Advocate Erin M Collins

Irs Delays Will Be Extraordinarily High Again Warns The Agency S Taxpayer Advocate

Nta Blogs Taxpayer Advocate Service

Pin By Karthikeya Co On Tax Consultant Advocate Accounting Analyst